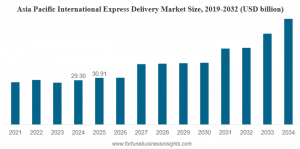

International Express Delivery Market to Reach USD 138.44 Billion by 2034, At 8.4% CAGR (2026–2034)

The market is driven by rising cross-border e-commerce, demand for fast shipping, global trade expansion, supply chain digitalization.

Rising Cross-Border E-Commerce Volumes Accelerate Express Delivery Demand”

PUNE, MAHARASHTRA, INDIA, February 3, 2026 /EINPresswire.com/ -- The global international express delivery market size 2026 represents a rapidly expanding component of modern logistics infrastructure, facilitating time-sensitive cross-border transportation of documents, parcels, and freight. According to Fortune Business Insights, the market was valued at USD 67.47 billion in 2025 and is projected to reach USD 138.44 billion by 2034, growing at a compound annual growth rate of 8.4% during the forecast period.— Fortune Business Insights

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/international-express-delivery-market-114754

Market Overview

International express delivery encompasses fast, time-bound transportation services that move goods across international borders using premium courier networks. These services provide expedited pickup, customs clearance, real-time tracking capabilities, and guaranteed delivery timelines. Both businesses and individual consumers rely on these networks for urgent, high-value, or time-sensitive shipments requiring reliable global connectivity.

The sector serves diverse applications including e-commerce fulfillment, manufacturing supply chains, healthcare logistics, automotive parts distribution, and financial document transmission. Market participants range from global integrated carriers operating extensive air networks to specialized regional providers focusing on specific trade corridors.

Key Growth Drivers

Several interconnected factors propel market expansion. Cross-border e-commerce continues surging as consumers increasingly purchase from international retailers, creating sustained demand for trackable parcel movement. Global trade expansion and supply chain digitalization enable businesses to source materials and sell products across continents with unprecedented efficiency. Improved logistics infrastructure, particularly in developing economies, enhances service reliability and coverage reach.

Consumer expectations have fundamentally shifted toward real-time visibility and shortened delivery windows. Modern buyers anticipate detailed tracking information and predictable arrival times, pushing logistics providers to invest in technology platforms that deliver transparency throughout the shipping journey. Small and medium enterprises increasingly participate in export activities, leveraging express networks to reach international customers without establishing overseas warehouses or distribution centers.

Time-sensitive sectors including healthcare and electronics generate particularly strong demand for premium delivery services. Pharmaceutical companies require temperature-controlled logistics for biologics and clinical trial materials, while technology manufacturers depend on rapid component replenishment to maintain lean production systems. These specialized requirements create opportunities for carriers offering value-added capabilities beyond standard transportation.

Market Segmentation Insights

The parcel and package express segment dominates service type categories, accounting for the largest market share while simultaneously recording the fastest growth rate. This dual leadership stems from efficiently managing high volumes of lightweight, time-sensitive cross-border shipments through established international air networks and automated sorting infrastructure. Expanding e-commerce activity, rising direct-to-consumer exports, and increasing small business participation drive accelerated demand within this segment.

E-commerce represents both the dominant and fastest-growing end-user industry. High volumes of cross-border shipping, rapid fulfillment requirements, and strong consumer expectations for fast trackable delivery reinforce sector leadership. Digital retail penetration rises globally as direct-to-consumer brands expand internationally and marketplaces increasingly depend on express networks for reliable time-bound parcel movements.

Road transport commands the largest mode share due to extensive regional connectivity, cost efficiency for short and mid-haul routes, and flexibility handling frequent movements between neighboring countries. Its ability to support dense delivery networks, enable rapid ground-based customs clearance, and provide door-to-door service strengthens market position. Air transport exhibits the fastest growth as demand increases for expedited cross-border deliveries, e-commerce exports, and guaranteed time-bound movement enabled by global cargo and freighter networks.

The deferred delivery tier holds dominant share by offering balanced cost efficiency and reliable transit for non-urgent parcels. It supports high shipment volumes for businesses prioritizing affordability over speed, particularly in business-to-business and bulk e-commerce exports. However, same-day delivery grows fastest, fueled by rising expectations for ultra-rapid fulfillment, expanding premium e-commerce services, and increased adoption by brands seeking competitive differentiation.

Business-to-business transactions dominate consumer type segmentation as companies consistently require reliable movement of high-value components, samples, spare parts, and contract-based shipments. Structured supply chains, predictable shipping cycles, and strict documentation requirements reinforce segment leadership. Consumer-to-consumer delivery records fastest growth driven by global gifting, second-hand marketplace activity, and increased participation in cross-border resale and personal shipping.

Regional Market Dynamics

Asia Pacific commands both the largest market share at 45.81% in 2025 and the fastest regional growth rate. Massive e-commerce volumes, strong manufacturing exports, dense small business trade participation, and rapidly expanding cross-border retail activity drive regional dominance. China, Japan, India, and Southeast Asia contribute significantly through rising digital adoption and increasing consumer preference for fast trackable deliveries. Extensive air cargo expansion, growing fulfillment centers, and strengthened regional logistics corridors further accelerate market growth.

Europe represents the second-largest market, supported by mature cross-border trade flows, integrated regional logistics frameworks, and strong regulatory standardization across the European Union. High consumer preference for reliable delivery, well-developed road and air networks, and strong parcel volumes from fashion, electronics, and luxury sectors sustain market position. E-commerce penetration, inter-EU shipment consolidation, and stable business demand contribute to steady growth.

North America maintains significant share driven by strong enterprise adoption, robust business-to-business demand, and high e-commerce export activity. Advanced air cargo networks, technology-driven last-mile systems, and large-scale automated hubs enhance operational efficiency. Growth stems from increasing cross-border trade with Asia Pacific and Europe, rising small business exports, and expanding premium delivery services.

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/international-express-delivery-market-114754

Competitive Landscape

The market features concentrated competitive dynamics with leaders including DHL Express, FedEx Corporation, UPS, SF Express, and Aramex commanding majority global coverage and premium service contracts. These providers continuously expand air freight capacity, invest in automated hubs, and enhance digital customs clearance systems. Strategic alliances with e-commerce platforms and regional logistics firms support localized fulfillment, lower cost structures, and differentiated service tiers.

Industry participants focus on network expansion, improving last-mile delivery capabilities, and enhancing tracking visibility. Investments in automation, air cargo capacity expansion, digital customs clearance, and sustainable logistics solutions strengthen competitive positioning. Technology partnerships enable faster, more reliable global delivery services as carriers seek to capture growing cross-border e-commerce volumes.

Emerging Trends and Opportunities

A significant market trend involves the shift toward time-definite and premium cross-border services. Growing portions of global shippers now prioritize next-day and two-day international delivery options, reflecting rising customer expectations and competitive pressure on retailers.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.